personal property tax relief richmond va

Personal property tax bills have been mailed are available online and currently are due June 5 2022. Tax returns are due on June 5 2022.

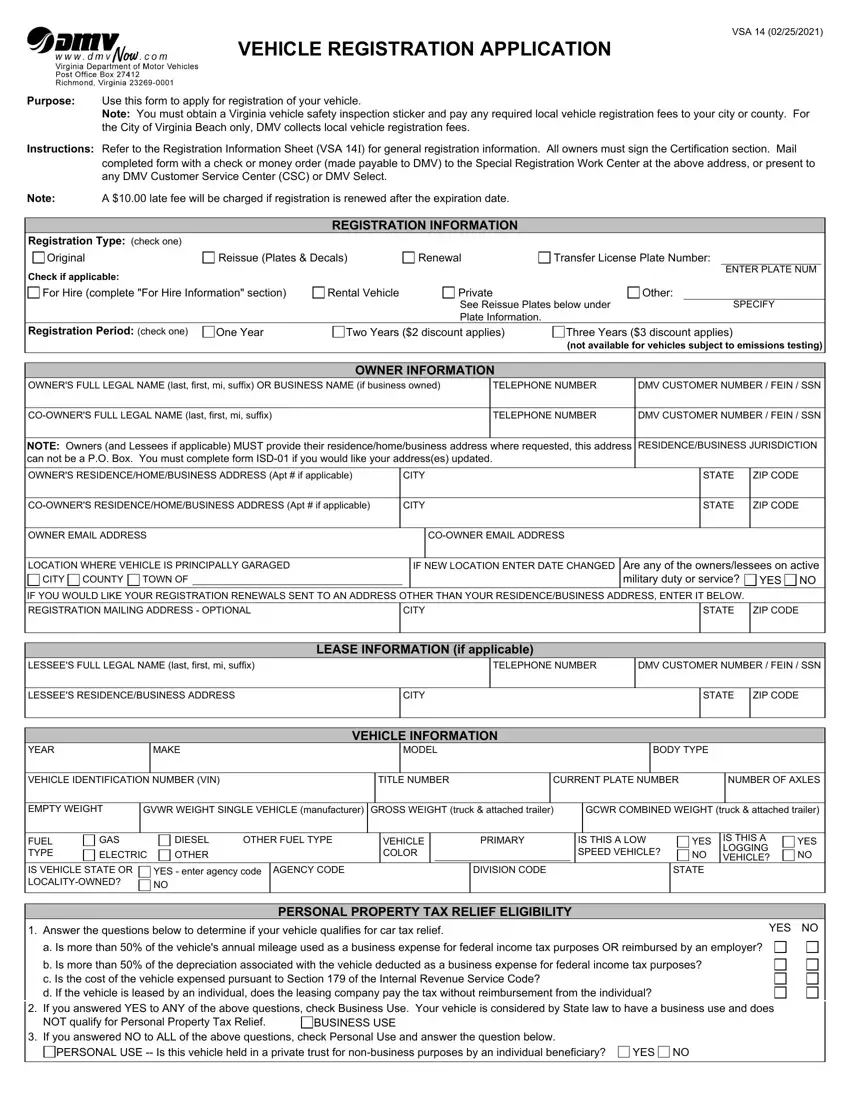

Dmv Form Vsa 14 Fill Out Printable Pdf Forms Online

Virginias Constitution also restricts what kinds of property tax relief city council can offer to Richmond residents.

. The relief is also only given up to the first 20000 of value for. About Personal Property Tax Relief. Taxpayers can either pay online by.

Answer the following questions to determine if your vehicle qualifies for personal property tax. Personal Property Tax Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Determining Qualifying Vehicles for Personal Property Relief.

For qualified vehicles your tax bill is reduced by the applicable tax relief percentage for the tax year on the 1st 20000 of value. Personal Property Tax Relief Real Estate Tax Relief for the Elderly Disabled Real Estate Assessment. Personal Property Tax Relief is available to vehicles that are used for personal use.

If you have any questions please contact the Department of Finance. Through the Personal Property Tax Relief Act of 1998 PPTRA the Commonwealth of Virginia grants partial relief of the personal property tax levied on the first. Richmond Va Residents Can Now Easily Pay Their Real Estate And Personal Property Taxes The tax rate for a vehicle worth less than 25000 is 150 per 100 of.

While Richmond offers either partial or full tax relief to. Personal Property Tax Relief Does Your Vehicle Qualify for Personal Property Tax Relief. On July 26th the Board approved a 52-cent per 100 assessed value credit to taxpayers on cars trucks and motorcycles on the second installment bills due December 5th.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. Prince William County is located on the. Taxpayers can either pay online by visiting RVAgov or mail their payments.

Code 581-3523 is determined by the Commissioner of the Revenue COR of the county. Welcome to the official site of the Virginia Department of Motor Vehicles with quick access to driver and vehicle online transactions and information. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

In general a qualifying vehicle Va. It was established in 2000 and is a member of. Tax rates differ depending on where.

Personal Property Tax Relief. About the Company Personal Property Tax Relief Richmond Va. The City of Richmond has mailed personal property tax bills and are also available online.

The local governing body of each county city or town shall fix or establish its tangible personal property tax rate for its general class of tangible personal property which. The City of Roanoke will be reimbursed by the.

Value Of Used Cars Impacting Personal Property Taxes Vpm

Chatham County Ga Property Taxes High Apply For Exemptions By April 1

Frederick County Va Commissioner Of The Revenue

How To Reduce Virginia Income Tax

News Flash Chesterfield County Va Civicengage

Finance Henrico County Virginia

Real Estate Tax Frequently Asked Questions Tax Administration

Virginians Likely Getting Money Back From Tax Rebates Lawmakers Debating How Much Wavy Com

We Want More People To Participate Richmond Encourages Homeowners To Apply For Real Estate Tax Relief Program

Louisa County To Provide Personal Property Tax Relief

Finance Henrico County Virginia

Property Tax Relief Available For Richmond Seniors Wric Abc 8news

The Complete Guide To Garnishment Exemptions Law Merna Law

Councilman Pushes For Tax Reform As Richmond Property Values Rise

Gov Youngkin Signs Law Allowing Localities To Lower Tax Rates On Vehicles Wjla

Are There Any States With No Property Tax In 2022 Free Investor Guide

Youngkin Proposes Nearly 400m In Tax Relief In Upcoming Budget 13newsnow Com